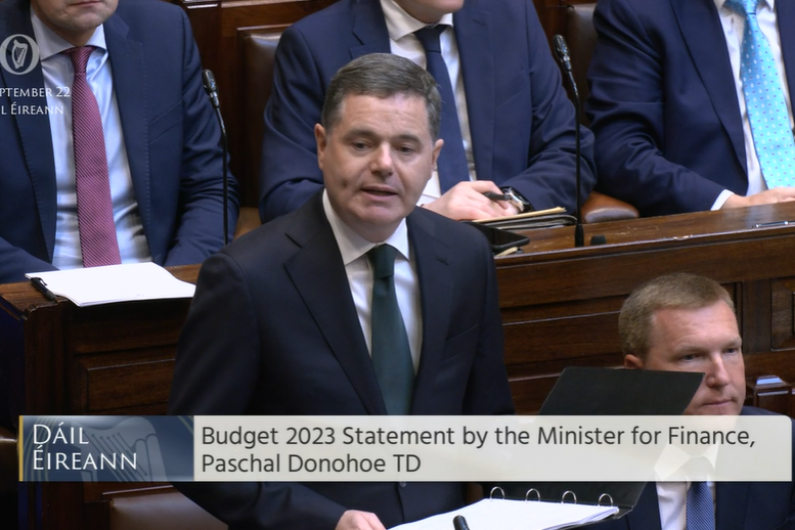

Finance Minister Paschal Donohoe is taking to his feet in the Dail about now to deliver the Budget 2023.

Its been described as the 'biggest budget giveaway' in years, which was signed off a full cabinet meeting this morning.

The Department of Finance estimates inflation of 8.5 per cent this year, and just over 7 per cent in 2023.

Families, students and pensioners are set to be the big winners with some households to get thousands of euro in benefits.

Income tax changes worth 800 euro a year are on the way to those on more than 40 thousand euro per year, while main tax credits are being increased by €75.

The second USC rate band will increase from 21,295 to 22,920 to take account of minimum wage increase of 80c per hour.

A 12 euro a week increase in core social welfare rates is also on the cards.

A 500 euro renters tax credit has been confirmed. 400,000 are set to benefit, it can be claimed for 2022 and 2023.

The pre-letting expenses for landlords is being doubled to €10,000 and the time a property must be vacant reduced from 12 to 6 months.

A Vacant Homes Tax is being introduced. It will apply to homes which are occupied for less than 30 days a year and it will be charged at a rate three times the Local Property Tax for the home and will be self-assessed.

Excise rate reductions of 21c on petrol, 16c per litre and 5.4c per litre in Marked Gas oil as well as the 9% VAT rate for electricity and gas has been extended until 28th February 2023.

The Carbon tax increase of €7.50 a tonne will go ahead as planned on October 12th. This will put up petrol and diesel by 2c a litre. However, the Government is reducing the National Oil Reserves Agency levy to 0% to offset the cost and it will be worth 2c a litre.

There will be two double payments of social welfare at Christmas and Halloween while student fees will be reduced by 1,000 euro for this year.

Cigarettes are going up by 50c for a box of 20 but there will be no increase in the price of alcohol.

VAT on defibrillators will be reduced to 0% from January the 1st while VAT on newspapers will be reduced to 0% from January the 1st, 2023.

A Temporary Business Energy Support Scheme has been announced to help those who are facing skyrocketing electricity bills.

Minister Pascal Donohue says it will be managed by Revenue and it's proposed the scheme will work by comparing average unit prices this year to the costs incurred last year.

Bank levy is to be extended for another year to raise €87m per annum while a levy on concrete blocks, pouring concrete and some concrete products will be introduced, to help pay for the MICA redress scheme.

This levy will come into effect from April of next year, and will be applied at a rate of 10 per cent. The Government has slashed the cost to apply for a special exception order to allow late night venues to operate.